Whole grains are growing at a remarkable rate – proving in market after market that consumers worldwide are beginning to understand the importance of enjoying more whole grains. To help those of you in the media paint the complete picture, we’ve collected industry figures, with the latest information first, to document the whole grain surge.

Success & Awareness of the Whole Grain Stamp

As of December 2025, the Whole Grain Stamp is now on:

• over 12,800 different products

• in 65 countries: Argentina, Australia, Bahrain, Bangladesh, Barbados, Belgium, Belize, Brazil, Canada, Chile, China, Colombia, Costa Rica, Denmark, Dominican Republic, Ecuador, Egypt, El Salvador, France, Germany, Ghana, Greece, Guatemala, Honduras, India, Ireland, Israel, Italy, Jamaica, Japan, Kuwait, Malaysia, Maldives (Republic of), Mauritius, Mexico, Nepal, Netherlands (Kingdom of), New Zealand, Nicaragua, Nigeria, Oman, Pakistan, Panama, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Romania, Saudi Arabia, Singapore, South Korea, Spain, Sri Lanka, Taiwan, Tanzania, Thailand, Trinidad and Tobago, United Arab Emirates, United Kingdom, United States, Uruguay, Venezuela, and Vietnam.

• By 332 WGC member companies based in 26 countries.

• At last count, 34% of all Stamped products can be found outside the United States.

Click here to learn more about the success of the Whole Grain Stamp.

Most Consumers are Interested in Ancient Grains

Survey data from Ardent Mills reveals broad interest and familiarity with ancient grains. Of note, the survey found that most consumers are interested in purchasing items with ancient grains, nearly 90% of respondents want to know more about ancient grains, and 63% of respondents are familiar with ancient grains.

Consumers willing to spend 10-15% more on ancient grains

Proprietary research from Ardent Mills, presented at the July 2022 Ancient Grains Conference, revealed that consumers are willing to spend 10-15% more for a retail product that contains ancient grains. According to World-Grain, “When asked their interest in purchasing products with ancient grains, 26% of respondents in the Ardent Mills research said they definitely would and 38% said they probably would.”

IFIC Survey Finds Whole Grain Interest for Numerous Health Benefits

The 2022 IFIC Food and Health Survey demonstrates strong and consistent interest in whole grains. This year, the survey found that of people who seek these particular health benefits, 53% report that they consume whole grains to improve cardiovascular health, 42% report that they consume whole grains to lose weight, 35% report that they consume whole grains to improve digestive/gut health, 34% report that they consume whole grains to improve immune function, and 33% report that they consume whole grains to improve energy/reduce fatigue.

62% of millennials say the “perfect dish” contains whole grains

In a survey from Just Food, Inc, 62% of millennials and 52% of baby boomers report that the “perfect dish” that is healthy, tasty, and good for the planet would contain whole grains.

Whole Grains Expected to Trend Upwards in China

According to food trend forecasts from Fitch Solutions, we can expect consumers in China to spend more on “healthier grains such as whole grains and cereals such as quinoa and millet.”

More than half of consumers are trying to eat more whole grains

According to the 2021 Food and Health Survey from IFIC, more than half of respondents are trying to consume more whole grains. Respondents found grains to have the smallest negative impact on the environment of all foods listed, indicating that consumers are aware of the sustainability of diets with grains. Additionally, ingredient-specific labels that identify ingredients that are included or excluded are seen as the most helpful to consumers in this survey.

young adults in ontario, canada embrace whole grains

The Grain Farmers of Ontario found that 43% of Ontarians aged 18-34 (a mix of younger millennials and older Gen Z) report that “they always look for whole grains when making purchasing decisions.”

FIBER AND WHOLE GRAINS MOST SOUGHT AFTER BY CONSUMERS, SAYS IFIC

According to the 2020 Food and Health Report from IFIC, nearly 80% of consumers perceive whole grains as healthful, edging all other food groups and nutrients listed except fiber (slightly over 80%). By comparison, less than 45% of consumers perceive enriched refined grains as healthful. Further, fiber, whole grains, and protein from plant sources were found to be the most sought-after foods/nutrients by consumers. The report also found that “more than half (54%) of all consumers say the healthfulness of their food choices matters more now than it did in 2010.”

Children’s Whole Grain Consumption increased significantly from 2005/2006 to 2013/2014

Researchers at USDA ERS and Univeristy of Georgia found that the ratio of whole grains to total grains rose from 7.6% in 2005-2006 to 13.48% in 2013-2014. The researchers note a strong association between the USDA’s whole grain standards for school meals (implemented in 2012) and higher whole grain consumption among schoolchildren.

People Ate More Whole Grains at Restaurants in 2015/2016 vs 2003/2004

In a January 2020 study in the Journal of Nutrition, researchers analyzed the nutritional content of fast-food and full-service restaurant dishes eaten by 35,015 adults between 2003 and 2016. Whole grains eaten at restaurants increased from 0.22 to 0.49 servings per day in full-service restaurants, and 0.08 to 0.31 servings in fast food restaurants. There were also slight increases in nut/seed/legume intake at fast food restaurants, as well as slight decreases in soda consumption at full-service restaurants and saturated fat and sodium consumption at fast food restaurants. Unfortunately, over this time period, people also at fewer fruits and vegetables at both types of restaurants, and the nutritional disparities between different racial and ethnic demographic groups persisted and, in some cases, worsened.

U.S. Whole Grain Intake Increases from 1999-2016

To see if nutrition initiatives are taking hold, researchers analyzed the diets of 43,996 U.S. adults in 1999 and then again in 2016. Over this time period, people got 1.23% more calories from high quality carbs (whole grains), 0.38% more calories from plant protein, 0.65% more calories from polyunsaturated fats, and 3.25% fewer calories from low quality carbohydrates (sugar and refined grains). Unfortunately, calories from saturated fat increased by 0.36%, and the general diet is still far from ideal, with 42% of calories still coming from low quality carbs, and saturated fat remaining above 10% of energy intake.

US Whole Grain Intake as a Proportion of Total Grain Intake Increases by 26% from 2005/06 to 2015/16

According to a July 2019 US HHS NCHS Data Brief, whole grain intake as a proportion of total grain intake rose among US adults by 26% (from 12.6% of total grain intake to 15.9% of total grain intake) in the period from 2005/06 to 2015/16. During 2013-2016, whole grains accounted for about 16% of total grain intake on any given day, with higher levels among older adults and those with higher incomes.

Fiber and whole grains top list of things consumers want to eat more of, says IFIC

According to the 2019 Food and Health Report from IFIC, more than 80% of consumers perceive whole grains as healthful, edging all other food groups and nutrients listed except fiber (nearly 90%). By comparison, less than 50% of consumers perceive enriched refined grains as healthful. The report notes that older consumers (50+) are more likely than younger consumers (18-49) to report trying to consume more fiber and whole grains. Regardless, fiber and whole grains topped the list of foods and nutrients that consumers would like to eat more of.

Millennials & Gen Z Seek Whole Grain Baked Goods

According to the American Bakers Association 2019 Study, millennials and Gen Z responded that “whole grains,” “freshness,” and “natural ingredients” are the most important nutritional descriptors across all product categories of baked goods.

Nearly 1 in 4 Shoppers Use Ancient Grains Weekly

In an interview for Food Business News, Cali Amos, of HealthFocus International, reports that half of shoppers are interested in ancient grains, and “nearly 40% saying they use ancient grains at least once a week.” Furthermore, “of those shoppers interested, more than 20% are willing to pay a premium for products that include ancient grains.”

Aramark Achieves 9% Increase in Whole Grains, Fruits, Veg

Over the past 3 years, Aramark, the largest U.S.-based food service company has achieved a 9% increase across whole grains, fruits, and vegetables, as part of the Healthy Life for 20 by 20.

61% Recognize Whole Grains as Good for Digestive Health

New Nutrition Business released a survey of 3,000 people from the United Kingdom, Australia, Spain, Brazil and the United States about which foods people think are good for digestive health. Overall, 61% recognized that whole grain choices were good for digestive health, and only 4.5% thought that whole grains were bad for digestive health (the lowest of any of the 11 categories included). Only fruits, veggies, and yogurt scored higher in consumers minds, at 83%, 78%, and 69%, respectively.

Sales of Whole Wheat Pasta Expected to Grow 18% in Italy

Data presented at the 2018 World Pasta Day meeting indicates that sales of whole wheat pasta are expected to grow by 18% in Italy, and that the sales of specialty pastas (such as those made with farro or Kamut®, are expected to grow by 12%.

brown rice sales increase 40% in singapore

Brown rice sales have increased by 40% at NTUC Fairprice (Singapore’s largest supermarket chain), in the six months leading up to March 2018. NTUC Fairprice and other retailers have also offered periodic discounts on healthier products, like brown rice, to encourage better nutrition.

Ancient Grains Trending, according to Euromonitor

In Euromonitor’s “8 Food Trends for 2018” report, healthy living is recognized as one of the eight megatrends, with ancient grains being called out as an example of this trend in action, and consumers’ preference for “naturally functional” foods. Additionally, Euromonitor lists baked goods, savory snacks, and confectionary as top categories to watch for innovation — all of which are well suited for reformulating with more whole grains.

8 in 10 Consumers Know that Whole Grains are Healthy, Finds IFIC

In the International Food Information Council’s (IFIC) 2018 Food and Health Survey, whole grains top the list of components considered to be healthful by consumers, following only vitamin D and fiber. Consumers are also differentiating between whole grains and enriched grains, as more than 80% recognize whole grains to be healthy, but less than 45% think that enriched grains are healthy.

Survey Results Show Consumers Want More Whole Grains & Fiber

According to a food consumption analyst at NPD Group, their survey data shows that consumers are looking to achieve better overall wellness through their eating habits. They are doing this by seeking out nutrients like protein (56% of consumers), whole grains (52% of consumers), dietary fiber (51% of consumers), and vitamin C (50% of consumers), while avoiding ingredients like sugar.

Shipments Of Ancient Grains To Foodservice Outlets Increased By Double-Digits in 2017

According to NPD’s SupplyTrack®, a service that tracks products shipped from distributors to more than 700,000 foodservice operators, case shipments of quinoa and amaranth increased by 18.5% and 19.4%, respectively, in the year ending October 2017. Similarly, spelt and farro also experienced double-digit growth in case shipments over this time period.

58% of consumers seek more whole grains

According to the Hartman Group’s 2017 Health and Wellness Report, 58% of consumers are seeking more whole grains in their diet. The report suggests that this is driven by an interest in ancient grains, fiber, mindful sourcing, and overall wellness. Comparatively, 63% are seeking more fiber, 60% are seeking more protein, 59% are seeking more vitamin D, 57% are seeking more nuts and seeds, 42% are seeking more omega-3 fatty acids, and 32% are seeking more plant-based protein.

Fewer Australians Choose to Limit Grain Foods in 2017

According to a survey from the Grains and Legumes Nutrition Council in Australia, less than half of people today (47%) choose to limit the amount of grains they eat, compared to 60% in 2014. This is likely because interest in Paleo, low-carb, and gluten-free diets is waning.

Whole Grain Market Expected to Grow from 2017-2021

According to a new report from Technavio, the global whole grain foods market is expected to grow at a compound annual growth rate of 6.71% from 2017-2021. The report finds that sprouted grains are an especially popular trend, and suggests that one of the major drivers for this market growth is the significance of the health benefits of whole grain foods. The report warns that identifying whole grain foods may be a challenge for the market — all the more reason for makers of whole grain foods to utilize the Whole Grain Stamp!

US Whole Grain Intake Increases by 50% from 2003/2004 — 2013/2014

According to US National Survey Data (NHANES), whole grain intake significantly increased across all age groups from 2003/2004 to 2013/2014, moving from 0.6 ounce equivalents per day to 0.9 ounce equivalents per day. Additionally, intake of refined grains significantly decreased during the same time period, moving from 6.3 to 5.7 ounce equivalents per day (a nearly 10% decrease).

Whole Grain Pasta Shows Highest Potential in Overall Pasta Market

According to a report on the market for pasta from Market Research Future, “Whole grain pasta and gluten free pasta have shown highest potential in the market.” The overall pasta market is expected to grow at a compound annual growth rate of 5.85% from 2016-2023.

High Regard for Whole Grain Health Claims in the UK

According the the June 2017 Consumer Insights report from the UK Agriculture and Horticulture Development Board, the two food claims that are most widely considered healthy by adults in the UK are “high fibre,” at 78%, and “wholegrain,” at 75%. However, manufacturers aren’t fully taking advantage of these trends, as only 2.1% of new food and drink launches had a “wholegrain” health claim in 2016, and only 2.7% had a “high/added fibre” health claim. The report also notes that “consumers spend 5% more when health is the reason for choice.”

84% of Consumers Recognize Whole Grains as Healthy, 65%+ are Eating More

In the International Food Information Council’s (IFIC) 2017 Food and Health Survey, whole grains top the list of components considered to be healthful by consumers (84%), following only vitamin D (88%) and fiber (87%). In fact, the percentage of people recognizing whole grains as healthful is significantly higher compared to the previous year. Addtionally, more than 65% of consumers report that they are eating more foods with whole grains compared to years past. Older adults (ages 50-80) in particular are more likely to eat more foods with whole grains, compared to 18-49 year olds (70% vs. 62%). Download the full report here.

180,000+ PRODUCTS Reformulated in 2016, Many with Increased Whole Grains

According to the Consumer Goods Forum Health and Wellness Report (developed in partnership with Deloitte), a global survey of more than 100 of the biggest consumer goods and food companies, more than 180,000 products have been reformulated in 2016. Increasing whole grains is a key target for 25% of respondents, along with decreasing sodium (67%), sugar (61%), saturated fat (50%), and trans-fat (47%). The companies surveyed also overwhelmingly supported providing transparent, fact-based information to help shoppers make informed decisions.

Ancient Grains are Hot for 2017, says NRA

According to the National Restaurant Association’s 2017 Culinary Forecast, ancient grains are a top (#14) food trend, along with protein rich grains/seeds (#17). Non-wheat noodles (#33), farro (#50) black/forbidden rice (#53), and quinoa (#81) also made the list. Additionally, healthful kids’ meals were named as the #3 food trend of 2017, and of all of the aspects of healthful kids’ meals that stand out to chefs, whole grain items in kids’ meals (#16) got top billing. Download the full report here, or check out our summary blog.

Whole Grain Food Market Expected to Reach $46.2 billion by 2022

According to a report from Stratistics MRC, the market for Global Whole Grain and High Fiber Foods (estimated at $29.4 billion in 2015 ) is expected to grow at a compound annual growth rate of 6.6% through 2022, reaching $46.2 billion, with especially strong growth in the baked foods segment and in the Asia Pacific region. Researchers credit this demand to the improved tastes of whole grain foods, as well as increasing demand for nutritious products.

Most Shoppers Looking for Whole Grains

In a September 2016 report called “Better For You Eating Trends,” Mintel reports that, “well ahead of other ingredients, consumers are interested in protein (63%), fiber (61%), and whole grains (57%) when purchasing foods they consider to be healthy,” and that nearly ⅖ of consumers (38%) agree that healthy foods are worth the added expense.

Health influences 91% of Parents’ purchases

According to the “Shopping for Health 2016” report from the Food Marketing Institute and Rodale, a product’s healthfulness for children influences 91% of parent’s food and beverage purchases. In the same report, 43% of shoppers reported buying more whole grain foods.

Consumers Seek Whole Grains, Avoid Enriched Grains

According to the 2016 International Food Information Council (IFIC) Food and Health survey, more people are trying to avoid enriched grains (21%) versus seek them out (20%). Additionally, 76% of respondents rate whole grains as “healthy” (compared to only 33% for enriched grains), and 1 in 5 people have an improved opinion on the healthfulness of whole grains (in fact, 7 in 10 of these people report that they’re consuming more). Download the full report here, or check out our summary blog post.

WGC 2015 Consumer Insights Survey

Nearly two-thirds of Americans are making at least half their grains whole, according to the 2015 Whole Grains Consumer Insights Survey from Oldways Whole Grains Council. Rather than reprint all the trends and facts in this survey, we’ll simply link you to our blog written after the survey was released in August 2015.

International Awareness of Ancient Grains Grows, MAJORITY Want Whole Grains

In a 2015 international report from HealthFocus International, called “Fiber, Grains, and Gluten — A Global Perspective,” 71% of respondents (spanning 16 countries, across the Americas, Europe, and Asia) reported that they want whole grains as a source of nutrition in products. The report also found that the international awareness of ancient grains was up from 26% in 2012 to 28% in 2014, with 35% of the respondents expressing an interest in ancient grains. Fiber, a nutrient prevalent in many whole grains, was also a big area of interest for many people in the survey.

Whole Grains Grow rapidly in Restaurants

According to Datassential’s 2016 Trending Grains Report, the term “whole grain” is mentioned on 45% more menus now, compared to four years ago. Quinoa leads the way, appearing on 9% of all menus, and an impressive 22% of fast casual menus. Farro and Barley each appear on 3% of all menus and farro has a place on 13% of fine dining menus — a sign that chefs and foodies alike are being drawn to its fuller, nuttier flavor and satisfying texture.

According to Datassential, these grains have shown the strongest growth on restaurant menus in the past year (2016):

- Kamut (67% growth on restaurant menus)

- Sorghum (64%)

- Millet (46%)

- Quinoa (33%)

- Amaranth (29%)

- Bulgur (24%)

Based on 2015 sales trends, Grubhub (an online food ordering service) expects to see sales growth in many menu items containing whole grains, including:

- Farro (105% projected increase in sales)

- Kamut (92%)

- Quinoa (34%)

- Spelt (18%)

- Millet (15%)

- Teff (11%)

1 in 3 Diners Would Pay More For Whole Grain Menu Items

In a December 2015 survey of approximately 2,000 Americans, research firm Mintel found that 30% of respondents are interested in, and would pay more for, menu items that feature whole grains. This interest in whole grains is greater than the interest in non-GMO (29%), high fiber (28%), low sodium (26%), low sugar (26%) and gluten free (22%). Mintel also found that 21% of respondents order more whole grains at restaurants than they did the year prior, and that 53% are ordering them in the same amount.

1 in 5 Consumers bought Ancient & Sprouted Grains in the Past month

Food Formulation Trends: Ancient Grains and Sprouted Ingredients, a September 2015 report from market research firm Packaged Facts, found that nearly a fifth (19%) of American adults have purchased menu or grocery items with ancient grains in the past 30 days (the same percentage as for sprouted grains/ingredients).

Many consumers confused about gluten

A May 2015 survey found that 47% of consumers think rice contains gluten, and 34% believe that potatoes do. In fact, 5% think gluten is found in all carbohydrates!

Whole Grains a top claim in the deli

More than 1200 consumers surveyed in 2014 about how their values influence what they purchase in the deli. When asked to name the most influential claims in the deli, most cited were “local” (73%), “whole grain” (71%), “all natural” (69%), “no high-fructose corn syrup” (63%), “hormone free” (60%) and “grass-fed/pasture”(60%). Culinary Visions Panel, referenced in Deli Business, Feb/Mar 2015.

The Gluten-Free Market

A very small group — just 2.5% of U.S. households — accounts for 68% of gluten-free product sales in grocery stores; this group buys about 48 GF products for total spending of $185 annually. 18% of GF sales come from households purchasing just 6 GF products and spending $24 annually (less than 1% of their total annual grocery purchases. Light users account for the final 14% of sales, averaging 2 GF products for $6 annually. Interesting to note: households that made the most GF purchases still bought, on average, the same amount of regular bread, breakfast cereal, pasta, muffins and bagels as the average U.S. household. Full report here.

The Truth About Gluten Free: Market Size and Consumer Behavior for Successful Business Decisions, Ardent Mills 2014

Consumer momentum for whole grains

The 2015 Food & Health Survey documents continued momentum for whole grains among American consumers. Some key metrics include:

• 67% of Americans think whole grains are the most important item they look for on packages.

• 70% are trying to consume more whole grains.

Read our blog about the survey, or connect to the full IFIC report.

2015 Food & Health Survey, International Food Information Council, May 2015

Ancient Grains Enjoy Rapid Sales Growth

According to data from SPINS, a leading supplier of retail consumer analytics and insights, sales of ancient grains rose steeply in the 52 weeks ending July 13, 2014. Kamut® brand khorasan wheat saw the highest growth, at 686%, with spelt growing 363% during the same period. Gluten-free ancient grains also showed strong sales, with amaranth up 123% and teff up 58%. Click here to download a SPINS’ infographic detailing these sales trends and others – including the fact that packaged grains bearing the Whole Grain Stamp were up 19% during the past year.

CHEFs cite whole grains in top trends

The National Restaurant Association’s What’s HOT 2015 Chef Survey asked chefs to rank more than 200 trends for their popularity. Several trends related to whole grains were in the top 50, including:

#4 Healthful kids’ meals

#5 Natural ingredients/minimally processed food

#11 Non-wheat noodles/pasta

#12 Gluten-free cuisine

#13 Ancient grains

#14 Whole grain items in kids’ meals

#17 Nutrition

#26 Non-wheat flour (e.g. millet, barley, rice)

#34 Quinoa

#39 Ethnic Flour (e.g. teff)

#46 Black/forbidden rice

National Restaurant Association What’s HOT 2015 Chef Survey, December 2014

Quinoa up five-fold in five years

Global launches of new products made with quinoa rose 50% in the twelve months ending September 30, 2013 — and increased more than five-fold from Q3 2008 to Q3 2013. 38% of launches promoted their gluten-free properties.

Source: Innova Market Insights, quoted in Food Business News (Dec 16, 2013)

Whole Grains are a Top Motivator in Purchases

According to the 2012 Food & Health Survey from the International Food Information Council (IFIC) Foundation, the presence of whole grains in a product is a strong factor in influencing consumers to buy a product. When asked what considerations drove their purchases, consumers’ top choices were calories (71%), whole grains (67%), fiber (62%), sugars in general (60%), sodium/salt (60%), and/or fats/oils (60%).

IFIC 2012 Food & Health Survey

Taste Growing as Reason Consumers Choose Whole Grains

A 2009 survey of more than a thousand adults asked those who claimed they were making an effort to eat more whole grains to explain their reasons for making this effort.

36% of them said “I enjoy the taste.” This was up considerably from a 2006 study (below) where 13% cited taste as a purchase motivator. Other popular answers included “Whole grain foods are healthier” (76%); “In order to get more fiber” (69%); “To fill me up and help me lose weight” (53%); and “To get more vitamins and minerals” (44%).

It’s great to see that more than a third of those responding to this question see the nuttier, fuller taste of whole grains as a plus! This could explain why “about two third[s] of respondents reported that they prefer to buy breads and cereals made with whole grains.”

A Survey of Consumers’ Whole Grain and Fiber Consumption Behaviors, and the Perception of Whole Grains as a Source of Dietary Fiber. Kellogg Co., March 2009.

“I’m eating more whole grains”

A survey conducted by the American Dietetic Association asked consumers if they had been eating more, less, or the same amount of various foods over the past five years. 48% said they were eating more whole grains, while 45% said their whole grain consumption had stayed about the same. Consumers in the survey also reported increasing vegetables (49%), fish (46%), and chicken (44%), while decreasing beef (39%), pork (35%) and dairy (22%). In an interesting twist, gluten-free foods were among foods consumers said they were least likely to increase consumption of.

American Dietetic Association, phone interviews by Mintel Intl Group, May 2011

Sales of Stamped Products Continue to Soar

In September of 2010, we shared the first-ever data from our friends at SPINS and Mintel that proved products bearing the Whole Grain Stamp outsell similarly positioned products that don’t use the Stamp. When first reported, sales of natural foods and beverages with the Whole Grain Stamp had increased 12.8% compared to a year earlier, while those without the Stamp increased 9.5% in the same channels.

As part of our ongoing partnership with SPINS, we’re pleased to announce that naturally-positioned foods and beverages* bearing the Whole Grains Stamp continue to outpace the competition. In Q1 of 2011 alone, combined sales of natural and naturally-positioned products approved for Stamp use totaled a whopping $13.1M, up 7.4% when compared to the same 12-week period in 2010. The long-range forecast of 52 weeks showed even more impressive growth, yielding a sales increase of $79.5M, up 11.1% over the same period a year previous.

In May 2011, SPINS released information showing consumer demand for certification labels beyond organic is on the rise. In addition to labels like Fair Trade and Non-GMO, the Whole Grain Stamp helped sales of products rise an impressive 13.3% for all of 2010.

*”Natural and naturally-positioned products” as defined by SPINS. For more information, please visit www.spins.com .

WHOLE GRAIN GROWTH WORLDWIDE, 2000-2011

New product launches of foods making a “whole grain” claim have grown sharply since 2000. In fact, according to the Mintel Global New Products Database, in 2010 almost 20 times as many new whole grain products were introduced worldwide as in the year 2000.

| whole grain launches | increase over year 2000 | increase over previous year | |

| 2000 | 164 | — | — |

| 2001 | 264 | 61% | 61% |

| 2002 | 321 | 96% | 22% |

| 2003 | 417 | 154% | 30% |

| 2004 | 674 | 311% | 62% |

| 2005 | 855 | 421% | 27% |

| 2006 | 1601 | 876% | 87% |

| 2007 | 2262 | 1279% | 41% |

| 2008 | 2883 | 1658% | 27% |

| 2009 | 3006 | 1733% | 4% |

| 2010 | 3272 | 1895% | 9% |

| 2011 | 3378 | 1960% | 3% |

WG NEW PRODUCT LAUNCHES BY CATEGORY

Again according to Mintel, bakery, breakfast cereals and snacks now account for the largest number of new product introductions, with side dishes and meals gaining quickly. (This table got too wide so we eliminated alternate years – email us if you want the “odd” years.) 2012 data are through April 30, 2012.

| Category | 2000 | 2002 | 2004 | 2006 | 2008 | 2010 | 2011 | 2012 |

| Baby food | 3 | 7 | 8 | 29 | 55 | 86 | 102 | 39 |

| Bakery | 84 | 158 | 337 | 639 | 1092 | 1248 | 1228 | 488 |

| Breakfast Cereals | 37 | 74 | 175 | 414 | 824 | 971 | 1039 | 378 |

| Meals & Entrees | 7 | 11 | 25 | 71 | 127 | 116 | 129 | 47 |

| Side Dishes | 18 | 47 | 49 | 127 | 250 | 277 | 287 | 84 |

| Snacks | 2 | 17 | 57 | 286 | 435 | 485 | 484 | 195 |

| Other | 13 | 7 | 23 | 35 | 100 | 89 | 109 | 37 |

| Total | 164 | 321 | 674 | 1601 | 2883 | 3272 | 3378 | *1268 |

Sales of Whole Grain Products Increase

U.S. retail sales of whole wheat pasta reached $128 million in the 52 weeks ended Sept. 5, 2010, according to SymphonyIRI. Whole wheat pasta had an average selling price of $1.50, compared with $1.27 for regular pasta, and whole wheat pasta took up a 9% share of the pasta category. The retail sales covered U.S. grocery stores, excluding Wal-Mart Stores, Inc.

Baking Business, May 9, 2011

“In 2001, we generated 2% of our business from whole grains,” said J. (Bohn) Popp, vice-president of marketing at Aunt Millie’s Bakeries, Fort Wayne, Ind. “Today, 38% of the bread and rolls we sell contain at least some whole grain flour.”

Flowers Foods, Inc., Thomasville, Ga., also has experienced dramatic growth in demand for whole grain products. Over the past five years, sales have climbed 75%, the company said, noting that 100% whole wheat Nature’s Own variety bread has been a top seller for decades. “While white bread is still the largest segment in the South market, which is our core market, sales are declining as consumers switch to wheat bread or sandwich rounds.”

At Sara Lee Fresh Bakery, Downers Grove, Ill., the share of products with whole grain nearly doubled to 45% in 2010 from 24% in 2005, the company said. Sara Lee estimated overall share growth for the category at 27% in 2010 from 15% in 2005.

Baking Business, February 24, 2011

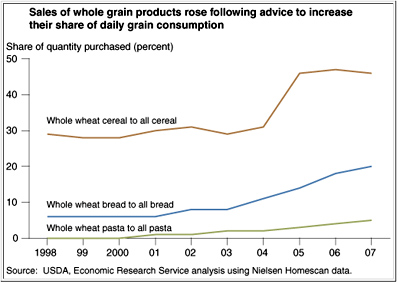

Using Nielsen Homescan data, ERS researchers found that in 2001, whole grain products accounted for 11.1 percent of all pounds of packaged grain products purchased in grocery stores (excluding flours, mixes, and frozen or ready-to-cook products). By 2006, whole grains’ share of total grain product purchases was 17.9 percent. ERS researchers found whole-grain breads accounted for 6 percent of all pounds of bread purchases in 2001 and rose to 20 percent by 2007. Over this same time period, whole-grain cereals jumped from 30 percent of all cereals purchased to 46 percent.

Amber Waves, USDA Economic Research Service (ERS), March 2011

Consumer Attitudes: Whole Grains Up, Refined Carbs Down more every year

When consumers were asked to “Please indicate whether you are trying to consume more or less of the following,” they said they were seeking out whole grains:

| 2006 | 2007 | 2008 | 2009 | |

| ”I’m trying to consume more whole grains” | 68% | 71% | 78% | 81% |

| ”I’m trying to consume less refined grains” | 56% | 61% | 65% | 67% |

IFIC Food and Health Surveys 2006-2009: Consumer Attitudes toward Food, Nutrition & Health

performed annually by the International Food Information Council.

CONSUMERS LOOK FOR WHOLE GRAINS AT BREAKFAST

In a survey conducted by Quaker Oats, 50% of the sample selected whole grain as the most sought after attribute when choosing breakfast foods. This was followed closely by fiber (47%).

Quaker Amazing Morning Survey, August 2010

CONSUMERS WANT TO INCREASE CONSUMPTION OF WHOLE GRAINS

37% of respondents identified “Increasing the consumption of foods with whole grains” as a Dietary Guideline-related action that they would be interested in doing.

IFIC Food and Health Surveys 2011: Consumer Attitudes toward Food Safety, Nutrition & Health; performed annually by the International Food Information Council.

Whole Grains Gain in Foodservice

Mintel Menu Insights tracks flavor and ingredient trends by regularly reviewing and analyzing more than one million items on 2,400 U.S. food and drink menus. Data analyzing the number of times whole grain foods appear on these menus show that whole grains made great gains in foodservice from Q2 2009 to Q2 2010. Here’s Mintel’s analysis of the top performers in the whole grains realm, and their increase in support of whole grains during this period:

| #1 in growth | #2 in growth | |

| Market segments with the most whole grain growth |

+ 36.1% Casual Dining | + 27.5% Fast Casual |

| Meal sections with the most whole grain growth |

+ 18.2% Appetizers | + 14.5% Entrées |

|

Ingredients showing the |

+ 33.3% Rolls | + 30.5% Linguini |

| Dishes showing the most whole grain growth |

+ 47.8% Breakfast Sandwiches | + 31.6% Pasta |

Grocery Shoppers Seek More Whole Grains

The Food Marketing Institute (FMI) conducts its “Shopping for Health” survey annually, to gauge shoppers’ attitudes to health and nutrition. In December 2009 it surveyed more than 1,423 adult shoppers on their preferences and shopping motivators. When shoppers were asked what they’re buying more of this year over last, their top five responses were:

49% whole grains

40% multigrain

39% fiber

37% low fat

34% low sodium

Whole Grains among top Functional Foods

83% of consumers named “whole grains and reduced risk of heart disease” when asked about their awareness of various foods and their health benefits. Two years ago, in 2007, only 72% were aware of the whole grain/heart link. Only Calcium/bone health and Vitamin D/bone health scored higher. In the same leading national survey, consumers named fiber (37%), whole grain (34%) and protein (28%) as the three food components they were most likely to choose to improve their own health – and calcium (39%, Citamin C (31%) and whole grain (26%) as the three they’d seek out most often for their kids’ health.

2009 IFIC Functional Foods / Foods for Health Consumer Trending Survey, August 2009, performed every 2-3 years by the International Food Information Council.

Americans Believe Whole Grains are Healthiest Foods

Whole grains topped the list when consumers were asked to pick the healthiest foods from a list of 70 foods and beverages generally considered good for you – and garnered fourth place, too, with oatmeal. Whole grains scored 59.5%, followed by broccoli (57.6%), bananas (56.9%), oatmeal (56.1%), green tea (55.1%), garlic (54.6%), spinach (54.6%) and carrots (52.4%).

Decision Analyst, February 2008

Consumers are Boosting their Intake

“Whole grains are of mounting interest to the US shopper. Sixty-one percent of shoppers report boosting their intake of whole grains in the past two years. This represents a spike of 17 points since the previous report in 2005 and a 27-point jump since the 1998 report.”

The 2007 HealthFocus Trend Report, A National Study of Public Attitudes and Actions Toward Shopping and Eating

Whole Grains and Fiber Take 3 of Top 6 Spots

When consumers were asked, unaided, to name a specific food or component with health benefits, these were the top six foods named. Compared to a similar survey two years earlier, awareness of whole grains grew 25% from 2005 to 2007.

Top Functional Foods

1. Fruits and vegetables

2. Fish, fish oil, seafood

3. Milk

4. Whole Grains

5. Fiber

6. Oats, oat bran, oatmeal

When asked about the specific benefits of the top functional foods, 72% of these consumers (again unaided) associated whole grains with benefits related to cardiovascular disease, and 86% associated both fiber and whole grains with intestinal health.

2007 Consumer Attitudes toward Functional Foods / Foods for Health. IFIC, October 2007

Taste Becomes One of Many Motivators

While it is commonly believed that many consumers eat whole grains despite their stronger taste, we are learning that some consumers have come to prefer the fuller, nuttier taste of whole grains – and only ten percent of those surveyed reported never eating whole grains.

“What is your primary reason for choosing to eat whole grain products?”

Nutritional value …32%

Increased fiber …31%

Better taste …13%

Reduced calories …4%

Change of pace …4%

Less refined grains …3%

Other …5%

None – I don’t eat them …10%

Harris Interactive Survey of 1,040 adults, conducted January 2006, titled “Healthy Eating: Impact on the Consumer Packaged Goods Industry”

Whole Grains and Health among Top RESTAURANT Trends for 2009

Two surveys from the National Restaurant Association name whole grains as a hot trend for 2009. In the NRA’s annual Chef Survey, 1600 kitchen maestros named quinoa the top trend in side dishes, while ancient grains garnered third place in “other food items/ingredients.” In the category of “Culinary Themes,” nutrition and health took first place.

In a separate survey, NRA members were asked “What trend do you see accelerating the most in 2009?” Taking first place — even over “productivity enhancements to offset rising costs” was “Increasing attention to health/nutrition.” The bottom line: whole grains will continue to accelerate in 2009, and the WGC will be there to help consumers and manufacturers benefit.

National Restaurant Association, December 2008

Whole Grain a Top Menu Trend for 2008

Mintel Menu Insights, by tracking restaurant menus across the country, identified 8 top restaurant trends for 2008 and “Grain Goodness” was Number 4. “With the health benefits of whole grains becoming more widely know,” stated Mintel, “certain nutritious grains will grow on the American restaurant menu. Kamut, quinoa, barley and millet pack a worldly punch along with healthy, esssential nutrients. These grains are the ideal backdrop for tomorrow’s innovative ethnic flavor and health trends.”

Wheat Bread Tops Sandwich Choices

A 2007 report from the International Dairy, Deli and Bakery Association (IDDBA) ranked the top 10 favorite breads for luncheon sandwiches. Wheat was number one, followed by Submarine/French (2), Multigrain (3), Sourdough (4), Croissant (5), Rye (6), Tortilla (7), White (8), Flatbread (9) and Pita (10).

Chefs Vote for Whole Grain Bread

In October 2007, the National Restaurant Association asked 1282 chefs to rate 194 different culinary trends as “hot,” “passé,” or “perennial favorite.” 28% rated whole grain bread as a perennial favorite, with another 56% rating it “hot.”

Whole Grain Flour Production up 26% in 1 Year

“The 26% growth in whole wheat flour production [in] 2005-06 represented an extra-ordinary pace of increase for an industry as mature as grain-based foods.”

World-Grain.com / Milling & Baking News, May 2007

| Year ending… | hundredweights (cwts) of whole grain flour |

increase over previous year |

| May 31, 2003 | 7,133,000 | —- |

| May 31, 2004 | 8,559,600 | 20% |

| May 31, 2005 | 9,844,000 | 15% |

| May 31, 2006 | 12,386,000 | 26% |

Market growth Q1 2005 vs Q4 2004

According to market research AC Neilsen, the whole grain market grew rapidly at the beginning of 2005:

| category | increase |

| Frozen whole grain prepared foods | 168% |

| Whole grain pasta | 27.4% |

| Whole grain cereal | 8.3% |

| Whole grain bread & baked foods | 7.4% |

More Growth, Year Ending June 18, 2005

| category | increase | sales now |

| WG cookies | 1364% | |

| WG muffins | 287% | $23.4m |

| WG buns (fresh) | 23% | $22m |

| WG bread & baked goods | 18.3% | $1.1b |

| WG crackers | 10.2% | $330m |

| WG cereal | 0.8% |

This growth compares to less than one percent growth in the whole grain market overall between 2000 and 2004.